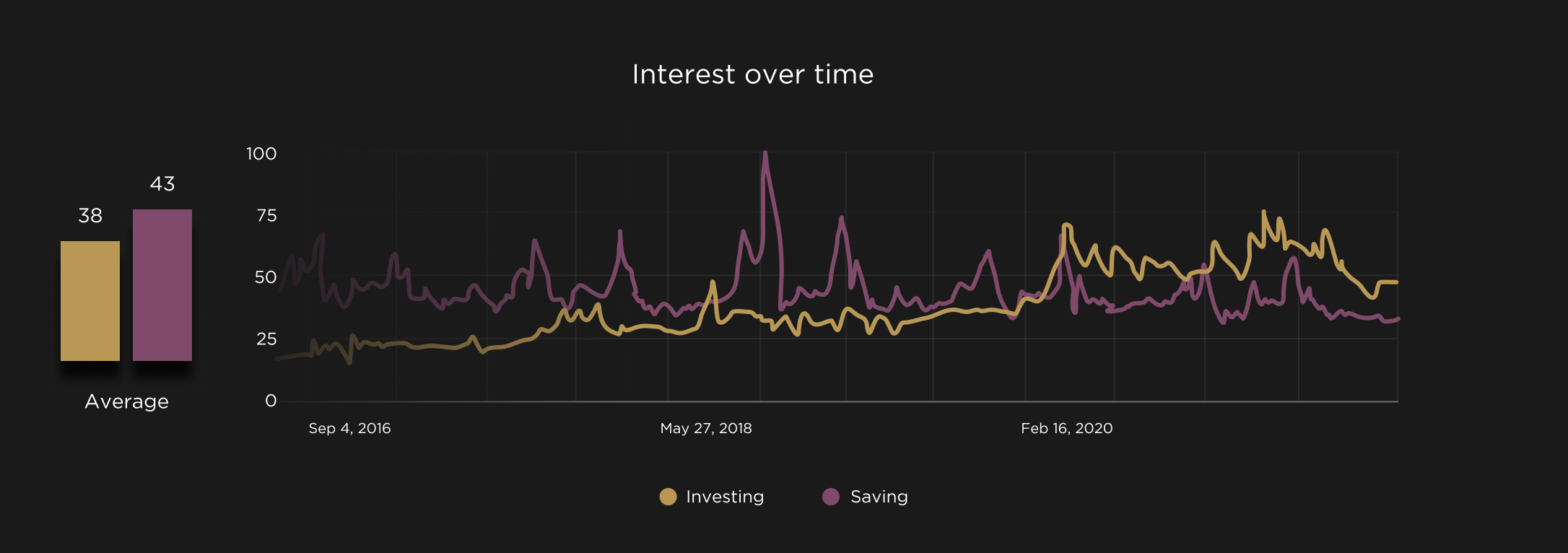

Saving versus Investing

Saving is setting money aside for future needs, unforeseen events or emergencies. It is usually deposited in an interest-bearing savings bank. The balance in your account doesn’t fluctuate with the financial markets and your funds are available immediately. After accounting for inflation, however, real interest rates on savings accounts are usually negative as your money loses spending power over time.

To preserve and grow wealth, money must earn much more than just the interest on a savings account. Investing part of your savings in risky financial assets generates income and capital gains over time. Your investment strategy in terms of risk, income, capital gains and time horizon depends on your financial situation and financial goals (e.g., children’s college funds or retirement). The value of your investments will fluctuate over time and your ability to sell them on short notice depends on the depth of the market for that particular asset.

Saving should be used as a relatively limited strategy to cover emergencies and specific short-term goals like buying a car, going on vacation, putting a down payment on a house, etc. Investments should be used as a strategy for long-term financial goals, such as preparing for retirement.

Although Investing has been empirically proven to outshine saving over the long run, investment losses are only too common for those who do not set financial goals and a long-term strategy to achieve them. A successful investment strategy requires careful consideration of the right asset allocation that matches the investor’s risk profile and objectives, while maximizing risk-adjusted return through diversification.

How Can Asset Managers Help?

A good asset manager grants you peace of mind by alleviating the stresses of managing your investment so you can focus on your own well-being, whether that entails career progression, personal business or self-improvement. An asset manager should start by understanding your objectives and risk appetite and then guide you with suitable solutions.

Book an appointment with our financial experts to launch your long-term investment strategy.

Did you find this article helpful? Learn more about wealth management and uncover the essentials of financial planning.