Highlights:

The Federal Reserve ( “Fed”) implements fourth 0.75% interest rate hike this year

The European Central Bank (ECB) raises rates by 0.75% for the second time in a row

Labor market remains robust

US GDP increases for the first time in 2022

Equities rally through the month

Policy & Geopolitics

The Fed continues its aggressive rate hike cycle

With inflation near its highest since the early 1980s, the Fed raised its federal funds rates by 0.75% on September 21 for a third consecutive time to a range of 3% to 3.25%, its highest level since early 2008. In its November 2022 meeting, the Fed implemented a fourth consecutive 0.75% interest rate hike this year. The market rally at the beginning of the meeting reversed when Fed Chair Jerome Powell stated that the terminal rate fed funds may be higher than expected as policy must be more restrictive.

U.S. Consumer Price Index (CPI) increased 8.2% year-on-year (YoY) in September from a peak of 9.1% in June, but still near its highest since the early 1980s. Excluding the volatile food and energy prices, core CPI rose 6.6% YoY, its biggest increase since 1982.

The reduction in the $8.9 trillion balance sheet of the Fed may slow or even stop completely by June 2023, more than a year ahead of market expectations, if the plans to unwind the balance sheet face complications through 2023.

Geopolitical tensions persist between Russia and the West over Ukraine

As the conflict in Ukraine escalates, the European Union (EU) is planning new sanctions against Russia after some European countries were banned from importing Russian oil.

Gazprom, the Russian energy giant, has suspended supplies to Poland and Bulgaria, for failing to pay for their energy in rubles. Fears that other countries could be similarly suspended have caused gas prices to soar. European Commission President Ursula von der Leyen stated that the EU was ready for this situation and had been working to ensure alternative deliveries and gas storage.

The EU is undergoing difficult discussions on whether to ban imports of Russian crude within six months and refined products by year end, but needs the unanimous approval of all 27 EU states, which is challenging given the rift between members.

The ECB raised rates by 0.75% for the second consecutive time

The ECB raised interest rates by 0.75% to 1.5%, their highest level since 2009, further increasing borrowing costs to cope with record inflation in the Eurozone despite the threat of recession. The aggressive hike was in line with expectations as rate setters focus on controlling inflation through monetary tightening despite growing criticism.

The ECB anticipates raising rates as long as inflation remains elevated. The deposit rate is expected to reach 2% in December and peak to around 3% in 2023.

The ECB has also taken a first step towards reducing its €8.8 trillion balance sheet, which is likely to further increase borrowing costs and act as a hidden rate hike. The ECB has also reduced its subsidy to commercial banks through €2.1 trillion worth of ultra-cheap three-year loans called Targeted Longer-Term Refinancing Operations (TLTRO).

Heavy explosions triggered a major gas leak on Russian pipelines.

On September 26, a series of explosions on the Nord Stream 1 and 2 pipelines caused a relese of gas on the surface of the Baltic Sea. The explosions triggered gas leaks at four locations (two in the Denmark economic zone and two in the Sweden economic zone).

Many suspect an attack, especially that the explosions occurred amid a hostile energy dispute between the European Union (EU) and Russia. The Kremlin has repeatedly denied claims that it damaged the pipelines, stating that the U.S. has the most to gain from gas leaks.

Macro Indicators

Labor Market Remains Robust

After falling to 3.5% in September, U.S. unemployment rose to 3.7% in October. The 261,000 jobs added in October exceeded the expected 190,000 as hiring remained strong. Health care led job gains, adding 53,000 jobs, while professional and technical services and manufacturing added 43,000, and 32,000, respectively. Labor force participation eased to 62.2%, down 0.1% since September. Average hourly earnings increased 4.7% YoY and 0.4% for the month.

In September 2022, unemployment in the Euro Area dropped to 6.6% from 6.7% in August 2022 and 7.3% a year ago.

Sources: Federal Reserve Bank of St. Louis, Eurostat

US GDP increase for the first time of the year

The 2.6% increase in U.S. GDP in Q3 2022, following a -0.6% fall in Q2 and a -1.6% drop in Q1, was above the Dow Jones forecast of 2.3%, driven by higher exports and consumer spending partly offset by lower housing investment. Spending increased 2.8% for services but fell 1.2% for goods. Consumer spending, which comprises around 70% of the U.S. economy, increased 0.6% in September, above the expected 0.4%, causing the August data to be revised upward.

September U.S. retail sales rose 8.2% YoY but were unchanged quarter-on-quarter after the August figures were revised to a 0.4% increase instead of 0.3%.

U.S. housing starts fell 8.1% in September to an annualized rate of 1.439 million, well below market expectations of 1.475. August figures were also revised downward to 1.566 million units from 1.575 million units.

Q3 2022 GDP in the Euro area and the EU increased 0.2%, slightly below the 0.8% and 0.7% rise in Q2 in the Euro area and the EU, respectively.

US CPI fell to 8.2% in September from a peak of 9.1% in June but remained near its highest since the early 1980s and above the 8.1% market forecast. Core CPI, which excludes food and energy, rose 6.6% YoY in September, the highest since 1982. In September, CPI and Core CPI were above estimates, rising by 0.4% and 0.6%, respectively, suggesting that inflation might remain elevated. Eurozone CPI reached a YoY high of 10.7% in October, above the 10.2% predictions.

The IHS Market Manufacturing Purchasing Managers’ Index (PMI) fell to 50.4 in October from 52.0 in September in the US and dropped to 46.4 from 48.4 in the Euro area.

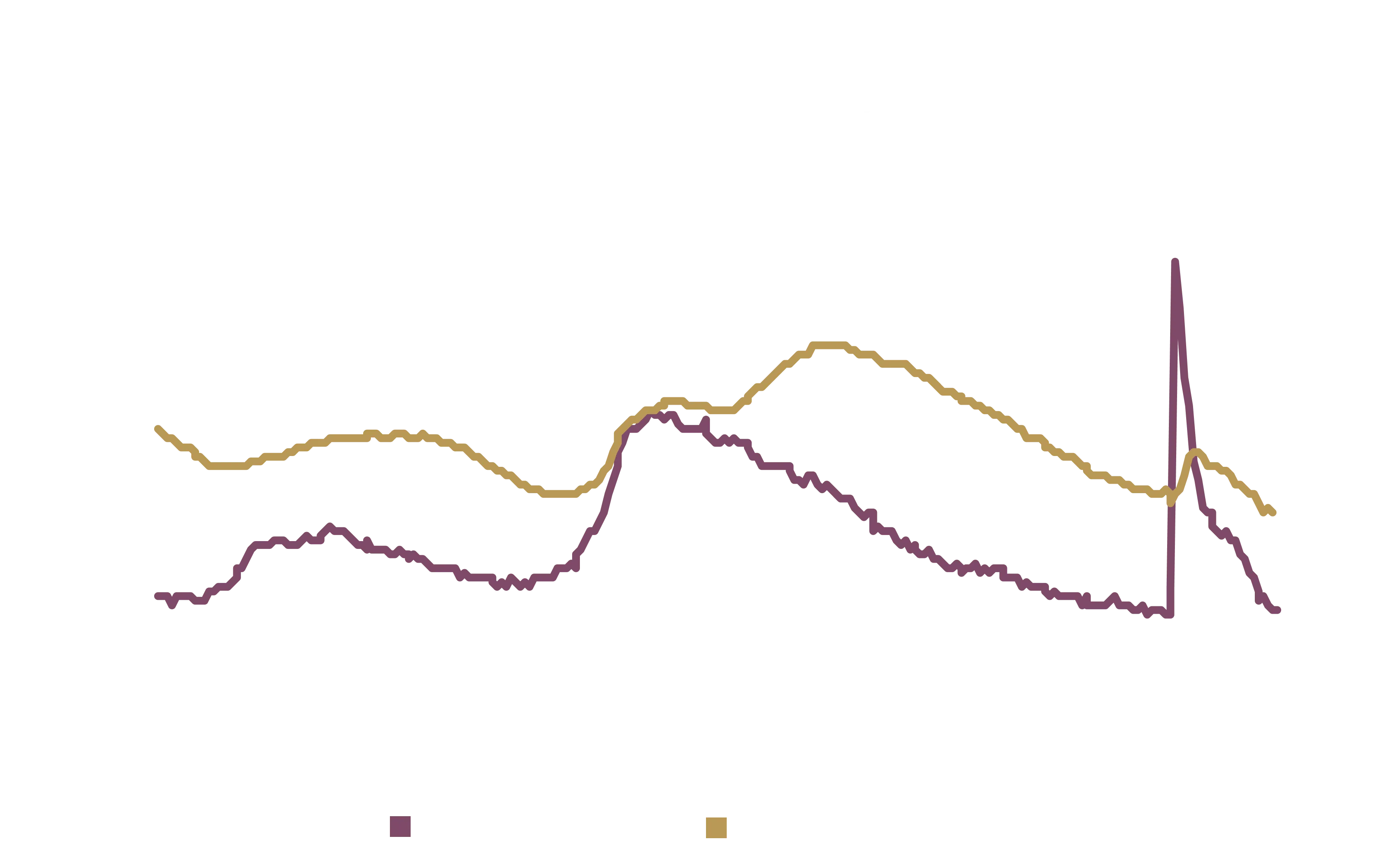

Sovereign bond yields rise amid Fed tightening

U.S. 10-Year Treasury yields closed October at 4.05% from 3.83% in September as the Fed remained hawkish. Germany’s 10-year bund yields also increased, closing October at 2.14% from 2.11% in September.

Source: Bloomberg *As of October 31, 2022

Source: Bloomberg *As of October 31, 2022

Financial Markets

Equity markets recover in October

The S&P 500, Dow Jones and Nasdaq rose 7.99%, 13.95% and 3.90%% in October, respectively. The market rallied in October driven by a strong labor market and expectations that the Fed might slow their tightening policy.

The STOXX Europe 600 and UK FTSE100 rose 6.28% and 2.91% respectively, in October. The Chinese SSE Composite Index and Hong Kong Hang Seng index fell 4.33% and 14.72%, respectively, while the Japanese Nikkei 225 Index rose 6.36%.

Credit spreads narrowing

Investment grade spreads narrowed slightly to 1.66% at the end of October from 1.67% in September, while high-yield spreads dropped to 4.63% from 5.43%.

Oil prices rise amid production cuts

Spot WTI and Brent crude oil prices rose from $79.49 and $85.14 per barrel, respectively, on 30 September to $86.53 and $92.81 at the end of October. WTI and Brent peaked on October 7 to $92.64 to $95.89, respectively. Oil prices increased throughout October as OPEC+ agreed the largest production cuts since 2020. Goldman Sachs raised its 2022 Brent forecast to $104 per barrel from $99, and its 2023 forecast to $110 from $108.

Source: Bloomberg

Source: Bloomberg

Opec+ will cut production by 2 million barrels per day starting November to reverse the declining trend, despite pressure from U.S. President Joe Biden to increase production and lower fuel prices ahead of the midterm elections next month.

After rising to historic highs last August to almost €340 per megawatt hour following Russia's invasion of Ukraine, EU natural gas prices have fallen considerably to €123 at the end of October. The latest report from industry group Gas Infrastructure Europe shows that overall EU gas storage is nearly 94% full, well above the 80% target set for the beginning of November. The conflict still impacts the region as the EU obtained about 40% of its natural gas from Moscow, which has since been dropped below 10%.

Source: Bloomberg

Source: Bloomberg

US dollar rises, gold and Bitcoin fall

The US dollar stayed above 100, reaching 111.53 on October 30. Meanwhile, gold prices fell 1.6% in October to $1633.56 with the stronger dollar, while Bitcoin increased 4.18% for the month to $20,412.72 but remains more than 70% below its all-time high of $68,789.6 on November 10, 2021.

Earnings

Mixed Tech earnings overall

Apple beat earning per share (EPS) and revenue estimates although their flagship iPhone disappointed. Fiscal Q4 revenue of $90.15 billion was above the estimated $88.90 billion while EPS of $1.29 exceeded the expected $1.27. iPhone revenue rose 9.67% YoY to $42.63 billion but was below the estimated $43.21 billion. Gross profits margin of 42.3% was above the expected 42.1%.

Amazon shares dropped over 10% after below-estimate Q3 earnings and a weak Q4 guidance. Revenue of $127.10 billion was below the estimated $127.46 billion while EPS of $0.28 was below the estimated $0.22. Amazon Web Services revenue of $20.50 billion was also below the estimated $21.10 billion.

Meta shares fell almost 20% in after-hours trading after another quarter of declining revenues. Revenue dropped 4% YoY to $27.71 billion but exceeded estimates of $27.38 billion while EPS of $1.64 was below the expected $1.89. Daily active users were in line with expectation at 1.98 billion, but average revenue per user of $9.41 was below the expected $9.83 amid increased competition from TikTok, the privacy policy change by Apple and a slowdown in online advertising spending.

Alphabet growth slowed to 6% from 41% a year earlier amid a continued slowdown in online ad spending. Revenues of $69.09 billion were below the expected $70.58 billion while EPS of $1.06 was below the expected $1.25. YouTube and Google advertising revenue of $7.07 billion and $54.48 billion, respectively, were below the expected $7.42 billion and $56.89 billion. But Google Cloud revenue of $6.87 billion was above the $6.69 billion expected.

Microsoft beat estimates despite softer cloud revenue. Revenue and EPS of $50.12 billion and $2.35, respectively, were above the expected $49.61 billion and $2.30. Revenue from the Intelligent Cloud segment of $20.33 billion was slightly below the expected $20.36 billion.

Tesla revenues of $21.45 billion were below the $21.96 billion expected, but EPS of $1.05 was above the expected $0.99. Automotive revenue increased 55% YoY to $18.69 billion.

Amazon Q1 2022 revenues grew 7.3% YoY to $116.4 billion, just above the estimate of $116.3 billion, while the EPS of $7.38 missed estimates of $8.36. Amazon could not beat consensus revenue estimates over the last four quarters.

Meta Q1 2022 revenues grew 7% YoY, its slowest since its 2012 IPO after consistent double-digit growth, to $27.9 billion, under analyst estimates of $28.2 billion. EPS of $2.72 was above expectations of $2.56. Facebook daily active users increased 4% YoY to 1.9 billion in March 2022.

Alphabet Q1 2022 revenues grew 23% YoY to $68.0 billion, in line with the expected $68.1 billion, while EPS dropped YoY to $24.62, below the estimates of $25.91. Meanwhile, Q1 EBITDA grew 24.4% YoY to $23.9 billion.

Microsoft Q1 2022 revenues grew 18% YoY to $49.4 billion compared to estimates of $49.1 billion, while EPS increased 9.4% to $2.22 against $2.19 expected. Office business offerings and Office consumer products and cloud services increased 12% and 11%, respectively. Total subscribers to Microsoft 365 consumer offerings were 58.4 million.

Tesla Q1 2022 revenues increased 87% YoY to $18.8 billion, beating estimates of $17.8 billion while the EPS of $3.22 EPS also beat expectations of $2.26. Gross profit margins rose to a record 32.9% with a gross profit of $5.5 billion in its main segment.

Sources: CNBC, VISA, AMEX, Reuters

Financials deliver strong earnings amid rising interest financial rates

JP Morgan Chase revenues and EPS of $33.49 billion and $3.12. respectively, were above the estimated $32.10 billion and $2.88. Profit dropped 17% YoY as $808 million were added to net reserves for bad loans.

Citigroup revenue rose 6% YoY to $18.51 billion, above the expected $18.25 billion with EPS of $1.63. Q3 2022 net income fell 25% YoY to $3.48 billion.

Morgan Stanley revenue and of $12.99 billion $1.47, respectively, were below the expected $13.30 billion and $1.49. Profit fell 19% to $2.63 billion while revenue decreased 12% driven by the fall-off in investment banking and declines in investment management revenue.

Goldman Sachs revenue and EPS of $11.98 billion and $8.25 were above the expected $11.41 billion and $7.69 forecast with approximately $3.53 billion in revenue from fixed income traders. Profit fell 43% to $3.07 billion.

Visa, Mastercard and American Express performed well in Q3 2022. Visa net revenues increased 19% YoY to $7.80 billion while EPS grew 13% to $1.86. Mastercard revenues grew 15% YoY to $5.80 billion, while EPS of $2.68 beat the estimated $2.56. American Express revenue increased 24% YoY to $13.60 billion while EPS grew 9% to $2.47.

Strong earnings for Energy and Industrials

Exxon Mobil earnings grew to $19.70 billion (EPS of $4.68) amid resilient volume performance.

Q3 2022 profits were the second-highest ever with booming global demand for oil and gas and increased production from U.S. oil fields. Net income was $11.20 billion (EPS of $5.78 vs estimate of $4.86).

The revenues of Caterpillar, often considered a barometer for the economic cycle, grew 21% YoY to $15.0 billion ($12.4 billion in Q3 2021) due to favorable price realization and higher sales volume. EPS grew to $3.87 from $2.60 a year earlier.

Sentiment

Improved consumer sentiment despite slower expected growth

The Consumer Sentiment Index of the University of Michigan increased 2.22% to 59.9 in October from 58.6 in September, despite dropping 16.5 % YoY.

The VIX index dropped to 25.88 in October from 31.62 in September, as equity markets recovered swiftly.

The month-end Fear and Greed Index (which uses seven factors including market momentum, safe-haven demand, and junk bond demand) showed “Greed” at 58 at the end of October as market expected that the Fed could slow their tightening policy.

COVID-19

COVID-19

The number of COVID-19 cases and deaths fell significantly since their January highs.

US daily cases in April were substantially below the January peak of 800,000, with a seven-day average of 57,654 cases compared to 500,000 at the end of January. As hospitalization cases dropped throughout the country, many state leaders opted to ease their mask and proof-of-vaccination requirements.

Daily Cases in Europe have more than halved last month, from just below 790,000 in late March to 374,000 at the end of April. Most countries in Europe are dropping travel restrictions and mandatory testing requirements due to the mildness of Omicron infections.

April was a very important month for Southeast Asia as Covid cases declined and travel resumed. Airline bookings are rising to destinations like Malaysia, Thailand and Indonesia as those countries allowed quarantine-free entry for vaccinated travelers.

China remains affected by Covid-19 with 282% in cases to 26,935 at the end of April. China adopted a zero-Covid policy, implementing lockdowns in cities such as Shanghai.

The Month Ahead

1. US Midterm Election

2. Fed Last Meeting of 2022 on December 14

3. ECB policy meeting on December 15

Disclaimer

This presentation is provided to you by The Family Office Co. BSC(c) (“The Family Office”) for informational purposes only, and contains proprietary information that may not be reproduced, distributed to, or used by, any third parties without The Family Office’s prior written consent.

All information, figures, calculations, graphs and other numerical representations appearing in this presentation have not been audited and may be subject to change over time. Furthermore, certain valuations (including valuations of investments) appearing in this presentation are subject to change as they may be based on either estimates or historical figures that do not reflect the latest valuation. Although all information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to their accuracy or completeness. The information contained herein is not a substitute for a thorough due diligence investigation. Past performance is not indicative of and does not guarantee future performance. Exit timelines, prices and related projections are estimates only, and exits could happen sooner or later than expected, or at a higher or lower valuation than expected, and are conditional, among other things, on certain assumptions and future performance relating to the financial and operational health of each business and macroeconomic conditions.

The Family Office makes no representation or warranty, express or implied, with respect to any statistics or historical or current financial data, whether created by The Family Office through its own research or quoted from other sources. With respect to any such statistics or data delivered or made available by or on behalf of The Family Office, it is acknowledged that (a) the investor takes full responsibility for making its own evaluation of the materiality of the information and the integrity of the quoted source and (b) the investor has no claim against The Family Office.

Amounts in currencies other than the US Dollar are translated using prevailing market rates as calculated by The Family Office or its service providers and may differ from the rates used by banks. The rates are indicative only and do not reflect the rates at which The Family Office would be prepared to enter into any transactions with other parties.

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “plans,” “estimates,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. To the extent this presentation contains any forecasts, projections, goals, plans and other forward-looking statements, such forward-looking statements are inherently subject to, known and unknown, significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond The Family Office’s control and may cause actual performance, financial results and other projections in the future to differ materially from any projections of future performance, results or achievements expressed or implied by such forward-looking statements. Investors should not place undue reliance on these forward-looking statements. The Family Office undertakes no obligation to update any forward-looking statements to conform to actual results or changes in The Family Office’s expectations, unless required by applicable law.

The Family Office makes no representation or warranty, express or implied, with respect to any financial projection or forecast. With respect to any such projection or forecast delivered or made available by or on behalf of The Family office, it is acknowledged that (a) there are uncertainties inherent in attempting to make such projections and forecasts, (b) the investor is familiar with such uncertainties, (c) the investor takes full responsibility for making its own evaluation of the adequacy and accuracy of all such projections and forecasts so furnished to it and (d) the investor has no claim against The Family Office.

This presentation represents a summary of certain information, the full terms of which are contained in a Private Placement Memorandum that should be reviewed for a more complete understanding of the investments and their risks. In addition, this presentation does not constitute an offer to sell, or a solicitation to buy, any instrument or other financial product, nor does it amount to a commitment by The Family Office to make such an offer at present or an indication of The Family Office’s willingness to make such an offer in the future.

The Family Office is a Category 1 Investment Firm regulated by the Central Bank of Bahrain C.R.No.53871 dated 21/6/2004. Paid Up Capital: US$ 10,000,000. The Family Office only offers products and services to ‘accredited investors’ as defined by the Central Bank of Bahrain.